Are you safe from a market collapse if you’re a long term investor ?

It's a pretty controversial question to start with. Nonetheless, it's one of the most critical questions that crops up in people's mind when they're thinking about making any investment decisions. Popular Media often touts that long term investors can ignore the daily , monthly or yearly market fluctuations. But that begs the question – who is a long term investor ? What is the time period a long term investor should be sitting tight on his investments for ?

Warren Buffet once said “Our favorite holding period is forever”. This quote is often used (and overused) in a bunch of investing forums and books.

But when I first read this quote, my immediate thought was “I’m NOT going to live forever ! I’d like to enjoy the fruits from my investing decision in this lifetime”. While a holding period of FOREVER might be ideal for holding companies and dynastic (inter – generational) trust funds, this quote clearly did not apply to me.

I started to ask myself, historically (again no future prediction involved), what is the minimum holding time for long term investors to make money ???

In order to find the answer, I analyzed the rate of returns of the S&P from 1930 to 2016 in 10 year and 20 year investment horizons.

Methodology:

This followed the same back of the envelope design/calculation we often employ in informal design discussions. The results need not be accurate to the 4th significant figure but should provide general idea about the feasibility of the design. So here’s what I did:

- Gathered the S&P index value at the start of each decade using http://www.multpl.com/s-p-500-historical-prices/table/by-year

- Dumped the data in Excel and figured out the 10 year nominal investment return , i.e. return without accounting for inflation.

- Figured out the cumulative inflation for each decade using http://www.inflationdata.com/inflation/Inflation/Cumulative_Inflation_by_Decade.asp

- Subtracted the cumulative inflation from the nominal return to get the real rate of return.

- Repeated the procedure for an investment period of 20 years.

- Defined a phase as a BULL phase if the REAL return on the investment was positive, otherwise defined it as a BEAR phase.

* There’s the concept of a Sideways Market – for for simplicity of analysis, I steered clear of that.

My basic goal was to figure out if I dumped my money in an Index Fund tracking S&P and sat tight for 10 or 20 years, would I have made or lost money ?!

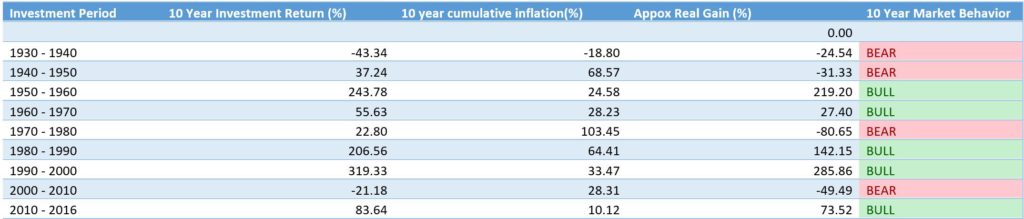

Data For 10 Year Investment Timeframe

The following conclusions jumped out :

- Notice how usually 2 bull market phases is followed by a Bear or Sideways market phase. This is what is effectively called "Reversion to the Mean" in efficient market hypothesis !

- The average nominal return on investments for a 10 year period is approx. 100%, i.e. a $100,000 investment becomes $200,000

- The average real return on investment for a 10 year period is approx. 62.5%. Notice how inflation eats into your purchasing power over a 10 year period .. yikes !!!

- The average gain during a BULL MARKET ways exceeds the average decline during a BEAR MARKET. This confirms an upward trend of the market in general over time.

- You have a very good chance of amplifying your gains if you start investing during a BEAR MARKET. So , next time there’s a bear market , rejoice (unless you’re near retirement), because your 401K investment dollars will have even greater expected return over their holding period.

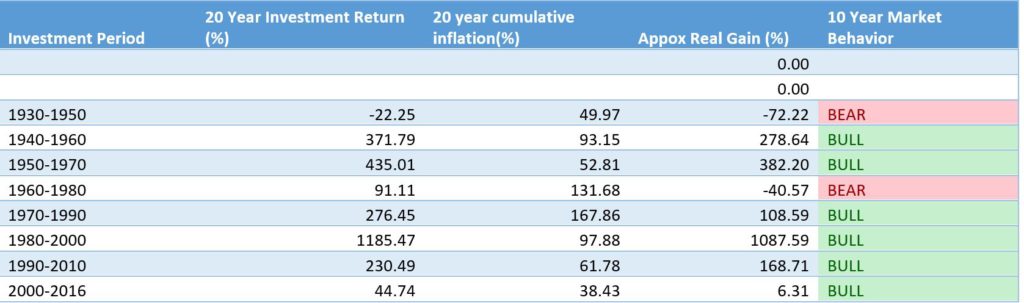

Data For 20 Year Investment Timeframe

The following observation can be made if we compare this data with the data for 10 year investment horizon:

- The Average nominal return for a 20 year investment period was 326%, i.e., a 100K investment became 326K.

- The average REAL return was approx. 240%

- Even with a 20 year Time Horizon , there were two periods where investors actually lost money !!!

- The investment periods where you lost money actually halved from a 10 year investment horizon to a 20 year horizon.

In light of the above facts, here's my own personal takeaways which I use in all my investing decisions:

- Investing in Stocks involves risk of losing money, even when looking at really long investment periods (20 years is plenty long for me personally).

- The longer you holding period for stocks, the better your chances of making money.

Parting words of wisdom:

1. If you're in your 20's or 30’s, Index investing is the best way to go. Use dollar cost averaging to get the best risk adjusted returns.

2. DO NOT, I repeat DO NOT Trade or try to use Trend Following techniques in your 401k and IRA accounts.

3. Invest money that you do not need for at least 10 years – anything shorter, and you run a big risk of losing money if your timing is incorrect.

4. I know that you're thinking this Index investing and dollar cost averaging is for the idiots – but 20 years from now, these will be the idiots with money !

5. If the thrill of Trend following and technical trading really excites you, divide your portfolio as follows:

A. Retirement Accounts : These includes IRA and 401K – index investing is the way to go.

B. Brokerage Investment Account: Typically here you'll save for a specific goal like buying a house. Use conservative investing practices. An example Portfolio(assuming you're in your 20s and 30s) is given below:

C. Brokerage Speculative Account : This is the FUN PART ! And after all, this is what this blog is all about. Note that you should not speculate with more than 10% of your portfolio !

*If you want to learn more about Asset Allocation to minimize financial risk , The Random Walk Guide To Investing is a great resource.

Well, hopefully you have a better grasp of what "Long Term Investment" means after reading this article – where you go from here – is a path you have to choose !